5x1000

A SMALL TOKEN FOR RENOVATION

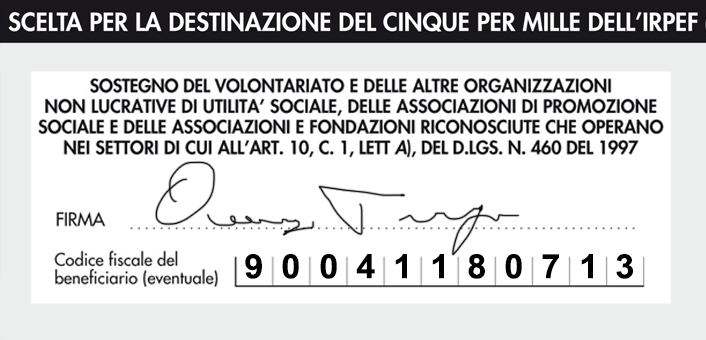

Sign and insert fiscal code

90041180713

In you tax returns declaration

Remember me

Why donate 5x1000 to Bordermind?

Donating your own 5x1000 to Boerdermind means supply youngster with all the useful tools they need to face the job market through workshops, seminars events; it also represents a real action to help the vulnerable communities thanks to projects that support autonomy, auto-determination and psychological support.

Our projects

How to donate my 5x1000 to Bordermind?

Donate 5x1000 to Bordermind is easy. You have 2 options:

If you are completing your tax return declaration

If you are completing Modello 730 or Unico:

- Populate the form on Modello 730 or Unico;

- Sign on the box “Sostegno alle organizzazioni non lucrative” (“Support no profit organization”);

- Select BORDERMIND fiscal code: 90041180713

If you are NOT completing your tax return declaration you can still donate you 5x1000 to Bordermind

- Populate the form in your CUD from your employer or your pension provider, signing on the box “Sostegno alle organizzazioni non lucrative” (“Support no profit organization”) and selecting Bordermind fiscal code : 90041180713;

- Insert the form in a closed envelope;

- Write on the envelope “DESTINAZIONE CINQUE PER MILLE IRPEF" (“To IRPEF 5x1000 funding”) along with your name, surname and fiscal code;

- Deliver it to a post office (it’s free!) or to an intermediary who is qualified to the electronic transmission (CAF, chartered accountant…)

Your 5x1000

Your 5x1000 is

FAQ

Answer

-

5x1000 is a type of funding that has no other charges attached to it. The Government gives the possibility to all citizens to select the destination of a part of his own IRPEF (5x1000) to support entities with a socially relevant activity

-

5x1000 can be donated by all citizens that complete their own tax return declaration via Modello 730, Modello redditi (previously known as Modello Unico) and Modello di Certificazione (previously known as CUD). In each of these models you can find a box called "Scheda per la scelta della destinazione del 5 per mille dell'Irpef" (To IRPEF 5x1000 funding). To donate the 5x1000 to Bordermind it’s enough selecting the first box in the top left corner with the title: “Sostegno del Volontariato e delle altre Organizzazioni Non Lucrative di Utilità Sociale..." (“Supporting Voluntary No profit Organization for social utility”), put your own signature and select Bordermind fiscal code: 90041180713’

-

Donating 5x1000 to an entity or association has no cost for the single citizen since this is a portion of IRPEF, so does not represent an added charge. If you decide not to donate 5x1000 to any organization that portion of your IRPEF will be then destined to the Government funding. There’s no increase in the tax to be paid, but only the right to choose to whom destinate 5x1000 and select who you really want to support.

-

5x1000 does not replace, but adds up to the 8x1000 and 2x1000 donation system. All of these are 3 possibilities offered by the Government to support 3 different entities: State and religious bodies (8x1000), association and research entities (5x1000) political parties (2x1000). Therefore all 3 of them can be selected.

-

The deadlines for the completion of the tax return declaration are as follows: - Standard Modello 730: 30 September 2021 if you’re completing the form by the mean of withholding agents 30/09/2021* if you are delivering the tax return to the Italian Tax Authority or by means of an intermediary - Prefilled Modello 730: 30/09/2021* for both direct delivery or by means of an intermediary - Modello redditi (previously known as Modello Unico Persone Fisiche ) 30/06/2021 if you’re completing the paper form by means of a post office; 30/11/2021 if you’re completing the electronic form *DL 09/20 art.1 regulates all the deadlines that can be postponed. For this reason we suggest to gather all the required information to the Italian Tax Authority for any deadline change to complete or change the tax return declaration.

-

Yes. You can donate the 5x1000 to Bordermind even if you don not have to complete your tax return. At no additional cost you can deliver to a post office or to an intermediary the 5x1000 endorsement (already attached to your CUD) in a closed envelope. You have to write on the envelope the following “scelta per la destinazione del 5 per mille dell'IRPEF" (“To IRPEF 5x1000 funding”) and your name, surname and fiscal code. All the citizens not obliged to complete the tax return declaration can make their selection for 8x1000, 5x1000 and 2x1000 delivering the form in a closed envelope, by 30 November 2020: -To the post office that will transmit your choice to the Italian Tax Authority (for free and with a receipt) - to an intermediary who is qualified to the electronic transmission (CAF, chartered accountant…). The intermediary must issue a receipt that confirms their obligation to send the form to the Tax Italian Authority. These intermediaries can request a payment for this service. – Directly through the telematics services of the Italian Tax Authority

-

If you are not selecting the fiscal code of the entity you want ot support, those fund will be destined proportionally to all the entities of the same category by the number of selection received.

-

All the donations are transferred to the entity anonymously and in a lump sum. The Government, for privacy reasons, can’t disclose the identity of the citizens that have expressed their preference to BORDERMIND.